What to Expect During a Home Appraisal?

You won’t want to miss this! When navigating the world of buying or selling a home, grasping the appraisal process is essential.

A home appraisal assesses your property’s market value. This can profoundly influence your financial decisions. This article unpacks what a home appraisal entails, guiding you through each step of the process while highlighting key factors that affect your home’s value.

You’ll also find valuable tips on how to prepare for an appraisal and what to anticipate afterward. Empowering you with the knowledge needed to make informed decisions for your next steps.

Contents

Key Takeaways:

Be prepared for a thorough evaluation of your home’s value during a home appraisal. To ensure you know what to look for, consider familiarizing yourself with what to expect during a home inspection, as this takes into account factors such as location, size, and condition.

Declutter your home now to make a strong impression! Fix any major issues and provide necessary documents to support your home’s value.

After a home appraisal, the appraiser will provide a report to the lender. The lender will then determine the loan amount based on the appraisal value.

Understanding Home Appraisals

Understanding home appraisals is crucial for you, whether you are a homebuyer or seller. It significantly influences mortgage processes and real estate transactions.

A home appraisal offers an impartial assessment of a property’s market value from a certified appraiser. This ensures you are fully informed of the fair market value before engaging in any pricing negotiations.

This evaluation considers various factors, including similar homes, current housing market conditions, and specific details about the property itself. It is an essential step in your home buying and selling journey.

What is a Home Appraisal?

A home appraisal serves as a professional evaluation that determines the appraised value of your property. It takes into consideration its condition, location, and relevant market data.

This thorough assessment examines numerous factors, including the size and age of your property, any improvements you have made, and recent sales prices of similar homes in your neighborhood.

The significance of this process in real estate transactions is immense. It provides both buyers and sellers with a dependable benchmark for pricing.

The appraisal report contains detailed elements such as a comprehensive description of your property, a comparative market analysis, and any influencing external factors. This valuable information guides your decision-making regarding offers and negotiations.

Understanding these components is vital for anyone involved in the buying or selling process. The final appraised value significantly impacts financing options and the overall stability of your home s value.

The Home Appraisal Process

The home appraisal process comprises several essential steps that guarantee a comprehensive evaluation of a property’s worth.

It begins with an appraisal inspection conducted by a licensed appraiser who follows established appraisal criteria. This methodical process aims to give a fair and precise assessment of your home s value, considering factors such as neighborhood conditions and local sales trends.

By grasping these steps, both sellers and buyers position themselves to prepare effectively. This ensures they meet the expectations set forth by mortgage lenders.

Step-by-Step Guide to a Home Appraisal

A home appraisal unfolds in a series of strategic steps, commencing with your initial request and culminating in the delivery of the final appraisal report that determines your home’s value.

This process begins with you, the homeowner or lender, clarifying the purpose of the appraisal whether it’s for a sale, refinance, or investment. Next, the appraiser gathers essential details about your property, such as its age, size, and unique features.

As the evaluation phase kicks in, the appraiser examines similar homes, known as “comps,” which have recently sold in your area. These comparisons are crucial as they provide the necessary context for your home s value, factoring in location, condition, and market trends.

Following a thorough analysis and site visits, the appraiser synthesizes all this information into a comprehensive report. This document reflects a well-informed estimate of your property s worth, ensuring you have a clear understanding of its value in the market.

In summary, understanding the appraisal process is vital for successful real estate transactions. Equip yourself with the knowledge and preparation to navigate this crucial step confidently.

Factors That Influence Home Appraisal Value

A multitude of factors influences the home value of your home, spanning from its physical attributes to external market conditions, such as the state of the neighborhood and recent sales trends of similar properties.

During the appraisal process, an appraiser carefully inspects crucial details like square footage, amenities, and the overall condition of your home. This ensures that the final appraisal accurately reflects its true worth.

Key Elements Considered by Appraisers

Key elements that appraisers consider in determining the home value include the physical attributes of the property, its overall condition, and the market value of comparable properties in the area. Understanding these aspects is essential for both buyers and sellers.

For example, the size of the property significantly influences its value; larger homes often command higher prices. The age of the home can signal potential maintenance issues or highlight renovations that may enhance or detract from its appeal.

An appraiser meticulously examines the condition of various components, from the roofing to the plumbing. By analyzing local market data, you gain insights into the latest trends and pricing strategies, which provide valuable context for the home value and inform your decision-making processes.

Preparing for a Home Appraisal

Get excited! Preparing your home well can lead to amazing results that truly reflect your property’s value. This preparation involves ensuring your home is in excellent condition, addressing any issues flagged during a previous inspection, and compiling an appraisal package that provides the appraiser with all pertinent information.

These steps increase the chances of a positive appraisal and highlight your home s best features.

How to Get Your Home Ready

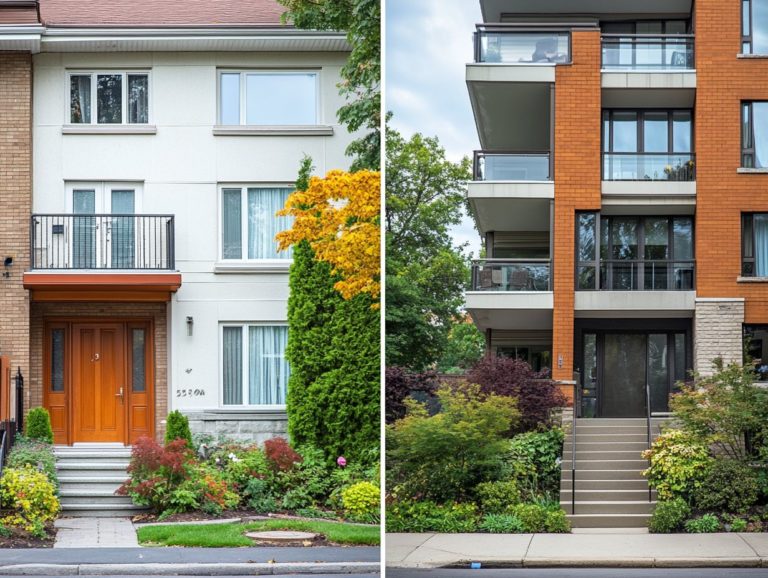

To prepare your home for an appraisal, prioritize enhancing curb appeal and ensuring all property details are meticulously in order. It’s also helpful to know what to expect with a home inspection. Begin by decluttering both the interior and exterior, creating an inviting and spacious atmosphere.

Undertaking minor repairs like fixing leaky faucets, patching wall holes, and ensuring doors and windows operate smoothly can significantly elevate your home s perceived value. During the appraisal, don t hesitate to showcase desirable features, such as updated kitchen appliances or energy-efficient systems; these elements can play a crucial role in positively influencing the outcome.

Maintaining a clean and well-kept property not only projects a favorable image but also cultivates a sense of trust with the appraiser, who will undoubtedly appreciate the attention to detail you’ve invested.

What Happens After a Home Appraisal?

Once your home appraisal is complete, the appraisal report will be generated and sent to your mortgage lender.

They will then utilize this information to make informed decisions about financing options and any necessary conditions that must be met related to the appraisal for you as a homebuyer.

Next Steps and Potential Outcomes

After your home appraisal, act quickly to review the report for accuracy and assess how the home value measures up to your expectations. Pay special attention to any potential gaps that might affect your decision as a homebuyer.

This evaluation is essential for grasping not only the property’s market value but also the financial implications for both you and the seller. If discrepancies come to light, it’s vital for all parties involved to engage in constructive dialogue.

This could lead to negotiations that adjust the sale price or require additional documentation to substantiate the stated value. Such negotiations can also have a significant impact on the mortgage lending process.

Lenders typically lean heavily on the appraised value to determine loan amounts and ensure that there s adequate collateral. Therefore, addressing any appraisal gaps swiftly is fundamental to ensuring the overall success of your transaction.

Frequently Asked Questions

Have more questions? Contact us to learn more about home appraisals!

What to Expect During a Home Appraisal?

During a home appraisal, a professional home appraiser will assess your property’s value. They will inspect both the inside and outside, take measurements and photos, and compare your home to similar homes sold recently. To better understand the process, it’s helpful to know what to expect during a home inspection.

How Long Does a Home Appraisal Typically Take?

A home appraisal can take anywhere from 30 minutes to a few hours. The time varies based on your home’s size and complexity.

Do I Need to Prepare for the Home Appraisal?

Make sure your home is clean and clutter-free. Have any necessary paperwork, like details of recent renovations, ready for the appraiser.

What Factors Do Appraisers Consider?

Appraisers consider several factors, including location, size, condition, and features of your home. They also look at similar homes sold recently in your area.

Can I Be Present During the Home Appraisal?

You can be present during the appraisal. Just remember to give the appraiser space to focus and do their measurements accurately.

What Happens After the Home Appraisal?

Once complete, the appraiser will send a written report with their findings, including your home’s estimated value. This report will help lenders determine loan amounts for potential buyers.