What Is a Lease-to-Own Option?

Navigating real estate can be daunting, but lease-to-own options offer an exciting path! This approach provides flexibility and opportunities for both buyers and sellers, but it also brings complexities that you ll need to navigate.

In this article, you’ll uncover the definition and fundamentals of lease-to-own agreements, explore their benefits, and weigh potential drawbacks. A step-by-step overview of how these agreements work will also be included, giving you a clear picture of the process.

Essential considerations will be addressed to ensure you re well-informed as you make decisions in this unique market. Whether you’re in the market to buy or sell, grasping lease-to-own options can completely change how you experience real estate!

Contents

- Key Takeaways:

- Understanding Lease-to-Own Options

- Benefits of a Lease-to-Own Option

- Potential Drawbacks of a Lease-to-Own Option

- How a Lease-to-Own Option Works

- Important Considerations

- Frequently Asked Questions

- What Is a Lease-to-Own Option?

- How Does a Lease-to-Own Option Work?

- What Are the Benefits of a Lease-to-Own Option?

- Are There Any Downsides to a Lease-to-Own Option?

- What Types of Properties or Items Are Commonly Offered Through Lease-to-Own Options?

- What Happens If the Individual Decides Not to Purchase the Property or Item at the End of the Lease Term?

Key Takeaways:

2. Buyers also benefit from the ability to test the property before committing to purchase, while sellers can secure a potential buyer and higher rent payments.

3. Buyers should be aware of potential drawbacks such as a higher purchase price and the risk of losing their option fee. Sellers should consider the potential for tenants who do not follow through with the purchase.

Understanding Lease-to-Own Options

Understanding lease-to-own options is crucial for you as a homebuyer exploring alternative pathways to homeownership. This is especially important in a market where traditional mortgage routes might pose challenges due to credit score limitations or hefty down payment requirements.

The lease-to-own model offers a range of agreements, including lease-option and lease-purchase contracts, granting you the unique opportunity to secure a property while renting it. This ultimately paves the way for a purchase agreement.

Definition and Basics

A rent-to-own agreement generally refers to a lease-option or lease-purchase arrangement, allowing you to rent a property with the potential to buy it later, typically after a set period.

In a lease-option agreement, you gain the exclusive right to purchase the home at a predetermined price, which is often outlined in the lease terms. Your monthly rent payments may contribute partially toward the eventual purchase, providing a pathway to ownership while you live in the home.

On the other hand, a lease-purchase requires you to buy the property at the end of the lease term, offering clarity but limiting flexibility. By understanding these distinctions, you can make an informed choice about the arrangement that aligns best with your financial situation and homeownership aspirations.

Benefits of a Lease-to-Own Option

Lease-to-own options can bring many benefits, especially for homebuyers facing challenges like a lower credit score or insufficient funds for a traditional down payment.

This approach stands out as a great choice if traditional mortgage costs are a hurdle, allowing you to explore homeownership without the immediate financial pressure.

For Buyers

For you as a homebuyer, the primary advantage of a lease-to-own agreement is the opportunity to build equity over time while enjoying the comforts of the home. This opportunity is particularly appealing if upfront costs associated with a traditional mortgage pose a challenge.

In this setup, a portion of your monthly rent can be credited toward the purchase price, allowing you to save for a future investment while reaping the rewards of homeownership. This arrangement offers you significant flexibility regarding down payments, and you might even have the chance to negotiate terms that require less cash upfront.

As you make regular rent payments, you re not just keeping a roof over your head you re also becoming more financially invested in the property, positioning yourself for eventual ownership and transforming your commitment into a valuable property over time.

For Sellers

For sellers like you, offering a lease-to-own option is a savvy move that can draw in potential buyers who might not qualify for conventional financing. This approach helps buyers benefit from market appreciation and shows their commitment to your property.

Not only does this strategy expand your pool of interested parties, but it also boosts the likelihood of closing a deal swiftly. With lease-option agreements, you maintain control over your property while enjoying the bonus of monthly rent payments, which can help cover costs like property taxes.

Often, a portion of that rent is credited toward the purchase price, motivating buyers to follow through on their commitment. This arrangement enables you to take advantage of real estate appreciation, all while potentially maximizing your sale price and easing the stress of selling in a competitive market.

Potential Drawbacks of a Lease-to-Own Option

Lease-to-own options present attractive advantages, yet they also harbor potential drawbacks that both homebuyers and sellers should carefully consider before committing to lease-option contracts.

For Buyers

For buyers, one notable drawback of a lease-to-own agreement is the risk of losing all the invested money, including any option fee and additional rent payments, if they can’t finalize the purchase due to credit score challenges or other financial hurdles.

This uncertainty can weigh heavily on emotional well-being and strain finances, especially if the entire investment ends up being a sunk cost.

Rising market prices can make the final purchase harder to achieve and more costly.

To navigate this challenging landscape, it s essential to carefully evaluate your financial situation and grasp the intricacies of lease-option contracts. By doing so, you can develop a solid plan that minimizes risks and protects you from potential losses, paving a more favorable path toward homeownership.

For Sellers

For sellers, the potential drawbacks of lease-to-own options can include navigating the complexities of closing costs and the possibility of property inspections. These factors might deter buyers and add to the ongoing maintenance demands of the property.

These added responsibilities can complicate the selling process. It s vital to know homeowner association rules to avoid surprises, as potential buyers might encounter restrictions that could limit their enjoyment of the property or even their eligibility for the lease-to-own arrangement.

If inspections reveal any issues, you may find yourself in a position to renegotiate terms, which can strain relationships and delay the transaction. This unpredictability heightens stress and can lead to financial repercussions, making it essential for sellers to prepare for these potential challenges.

How a Lease-to-Own Option Works

Grasping the intricacies of a lease-to-own option is essential for both buyers and sellers.

This arrangement entails specific agreements, such as lease-purchase and lease-option contracts, which define aspects like rent payments, the option fee, and the overall purchasing procedure.

Understanding these elements enables you to navigate the process with confidence and clarity.

Step-by-Step Process

The step-by-step process of a lease-to-own agreement starts with you, the homebuyer, and the seller sitting down to negotiate the terms laid out in either a lease-option or lease-purchase agreement. This includes crucial details such as the rent amount, option fee, and the specific conditions tied to your right to buy.

Once you’ve settled on the terms, the next step is signing the lease, ensuring both you and the seller have a clear grasp of your rights and responsibilities.

After the ink dries, you’ll begin making monthly payments that typically consist of rent, with a portion potentially credited towards the final purchase price.

Maintenance responsibilities are also explicitly outlined, so both you and the seller know who s accountable for repairs during the lease term.

As the lease progresses, you’ll have the opportunity to assess your financial situation and decide whether to move forward with the purchase, offering you a flexible and strategic path to homeownership.

Start exploring your lease-to-own options today and take the first step toward your new home!

Important Considerations

When considering a lease-to-own option, you must carefully assess the critical legal and financial implications that can profoundly influence the success of the agreement. This evaluation is vital for mortgage approval and home maintenance responsibilities.

These factors play a significant role in the overall dynamics of the arrangement.

Legal and Financial Implications

The legal and financial implications of a lease-to-own agreement can vary greatly. It’s essential to grasp the details of mortgage requirements and closing costs, and how they affect your obligations over time.

Navigating these complexities often calls for the expertise of a real estate attorney, who can clarify legal jargon and ensure compliance with all contractual stipulations. Misunderstandings can lead to significant financial burdens, such as unexpected fees or trouble securing financing at the end of the lease.

As a buyer, you must fully understand your mortgage eligibility; failing to meet the requirements set by banks for getting a loan could derail the entire process, leaving you in a challenging position.

It s crucial for everyone involved to engage in proactive discussions and detailed planning to mitigate potential risks and secure favorable terms.

Negotiating and Protecting Your Interests

Negotiating and safeguarding your interests in a lease-to-own agreement are crucial for both homebuyers and sellers. This process ensures that the terms of the lease-option contracts genuinely reflect the needs and expectations of everyone involved.

When you employ effective negotiation strategies, you can navigate this complex process with ease. As a homebuyer, prioritize securing favorable rental terms, clarifying maintenance responsibilities, and establishing purchase price options that align with current market trends.

Conversely, if you re a seller, focus on ensuring timely payments and protecting the integrity of your property during the rental period. Clear communication is key; it fosters trust and clarity around expectations, responsibilities, and timelines.

Engaging skilled legal representation is essential, as it assists in drafting enforceable agreements that safeguard your interests while minimizing potential disputes in the future.

Frequently Asked Questions

What Is a Lease-to-Own Option?

A lease-to-own option is a type of agreement where an individual leases a property or item for a specific period with the option to purchase it at the end of the lease term.

How Does a Lease-to-Own Option Work?

In a lease-to-own option, the individual pays monthly rent to the owner of the property or item. A portion of the rent goes towards the purchase price. At the end of the lease term, the individual has the option to buy the property or item, usually at a predetermined price.

What Are the Benefits of a Lease-to-Own Option?

A lease-to-own option allows individuals who may not have the funds or credit to purchase a property or item outright to still have the opportunity to own it. It also gives them time to save for a down payment and improve their credit score.

Are There Any Downsides to a Lease-to-Own Option?

One potential downside is that the individual is not guaranteed to purchase the property or item at the end of the lease term. They may also end up paying a higher price due to the portion of the rent contributing to the purchase price.

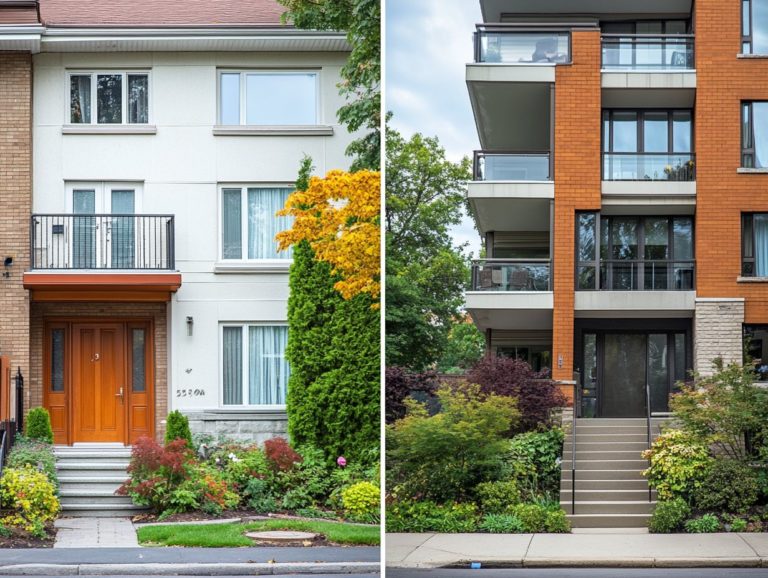

What Types of Properties or Items Are Commonly Offered Through Lease-to-Own Options?

Lease-to-own options are commonly offered for properties such as houses, condos, and apartments. They can also apply to items like cars, furniture, and appliances.

What Happens If the Individual Decides Not to Purchase the Property or Item at the End of the Lease Term?

If the individual decides not to purchase, they may lose the portion of the rent contributed to the purchase price. They may also need to move out of the property or return the item to the owner.

Don t miss out on your dream home understand these factors and consult a professional for personalized advice on lease-to-own agreements!